Table of Contents

1. Introduction

Social Security payments, administered by the Social Security Administration (SSA), are designed to provide financial support to individuals in various life circumstances. From retirees enjoying their golden years to those with disabilities requiring assistance, Social Security payments serve as a lifeline for many Americans.

2. Importance of Social Security

Financial Stability: Social Security payments offer a sense of financial stability, especially for retirees who may no longer have a steady income from employment. These payments provide a reliable source of funds to cover essential expenses, such as housing, healthcare, and daily living costs.

Retirement Benefits: For retirees, Social Security payments represent a culmination of years of hard work and contributions to the workforce. It ensures that individuals can enjoy their retirement years with dignity and security, without worrying about financial instability.

Disability Support: Individuals with disabilities rely on Social Security Disability Insurance (SSDI) payments to support themselves and their families. These payments help cover medical expenses, rehabilitation costs, and other necessities, offering much-needed financial assistance during challenging times.

Survivor Benefits: In the unfortunate event of a loved one’s passing, Social Security survivor benefits provide financial support to eligible family members, including spouses, children, and dependent parents. This assistance helps ease the burden of financial loss and provides a safety net for those left behind.

3. Understanding Social Security Payments

Eligibility Criteria: To qualify for Social Security payments, individuals must meet certain eligibility requirements, including age, work credits, and disability status. Eligibility criteria vary depending on the type of benefit sought, such as retirement, disability, or survivor benefits.

Types of Social Security Payments: Social Security offers various types of payments tailored to specific circumstances, including retirement benefits, disability benefits, survivor benefits, and Supplemental Security Income (SSI) for low-income individuals.

Factors Affecting Payment Amount: The amount of Social Security payments is influenced by several factors, such as earnings history, age at retirement, and claiming strategy. Understanding how these factors impact payment amounts can help individuals maximize their benefits.

4. Timing of Social Security Payments

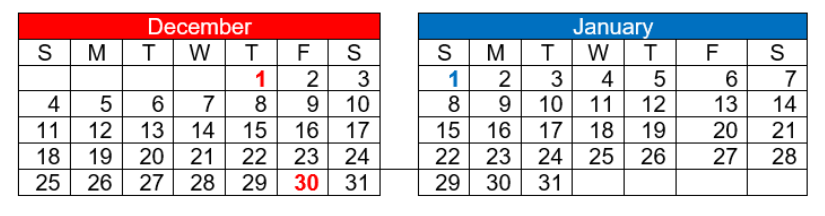

Monthly Schedule: Social Security payments are typically issued on a monthly basis, with most recipients receiving their benefits on the second, third, or fourth Wednesday of each month, depending on their birth date.

Exceptions and Holidays: In some cases, Social Security payment dates may be adjusted due to weekends, holidays, or other factors. It’s essential for recipients to be aware of any changes to their payment schedule to avoid potential disruptions.

5. How to Receive Social Security Payments

Direct Deposit: The most convenient and secure way to receive Social Security payments is through direct deposit into a bank or credit union account. This electronic transfer ensures timely delivery of funds without the risk of lost or stolen checks.

Social Security Debit Card: For individuals without a bank account, the SSA offers the option of receiving payments on a Direct Express Debit Mastercard. This prepaid debit card allows recipients to access their funds at ATMs and make purchases wherever Mastercard is accepted.

Paper Checks: While less common, some individuals still receive Social Security payments by mail in the form of paper checks. However, this method can be less secure and may result in delays in receiving funds, especially during postal disruptions.

6. Managing Your Social Security Payments

Budgeting Tips: To make the most of your homesdecoratingblog.com, it’s essential to create a budget that prioritizes your needs and aligns with your income. Identify essential expenses, such as housing, utilities, and healthcare, and allocate funds accordingly.

Financial Planning: Consider consulting a financial advisor to help you develop a comprehensive financial plan that takes into account your Social Security benefits, retirement savings, and other sources of income. A well-thought-out plan can ensure a comfortable and secure financial future.

Additional Income Sources: Depending solely on Social Security payments may not be sufficient to cover all your expenses. Explore additional income sources, such as part-time work, investments, or rental income, to supplement your benefits and enhance your financial stability.

7. Changes in Social Security Payments

Cost-of-Living Adjustments: Social Security payments are subject to periodic cost-of-living adjustments (COLAs) to account for inflation and rising living expenses. These adjustments help ensure that beneficiaries’ purchasing power remains relatively stable over time.

Legislative Updates: Changes to Social Security laws and regulations can impact payment amounts, eligibility criteria, and other aspects of the program. Stay informed about legislative developments that may affect your benefits and take appropriate action as needed.

8. Resources for Social Security Recipients

Government Websites: The SSA website provides a wealth of information and resources for Social Security recipients, including online account services, benefit calculators, and FAQs. Visit www.ssa.gov to access these resources and stay informed about your benefits.

Social Security Offices: Local Social Security offices offer in-person assistance and support to individuals seeking information about their benefits, applying for benefits, or resolving issues with their payments. Schedule an appointment or visit during office hours for personalized assistance.

Community Support: Joining online forums, social media groups, or community organizations dedicated to Social Security can provide valuable support and insights from fellow recipients. Share experiences, ask questions, and connect with others facing similar challenges.

9. Common Questions About Social Security Payments

For more information about Social Security payments, check out these frequently asked questions:

- How are Social Security payments calculated?

- Can I work and still receive Social Security benefits?

- What happens if I delay claiming Social Security benefits?

- Are Social Security payments taxable?

- What should I do if I haven’t received my Social Security payment?

In conclusion, Social Security payments play a vital role in providing financial security and support to millions of Americans.